Publications

Facing Estate Tax Challenges For Business Owners, Artists, And Gallery Owners

As 2024 progresses, the sunsetting of key tax provisions presents unique challenges for business owners, artists, art dealers, and gallery owners alike. With the estate tax exemption set to decrease and potential changes looming in capital gains and valuation practices, it is crucial to review and adapt estate and tax plans to avoid pitfalls.

Avoiding (or at Least Deferring) Taxes on the Sale or Gifting of Art

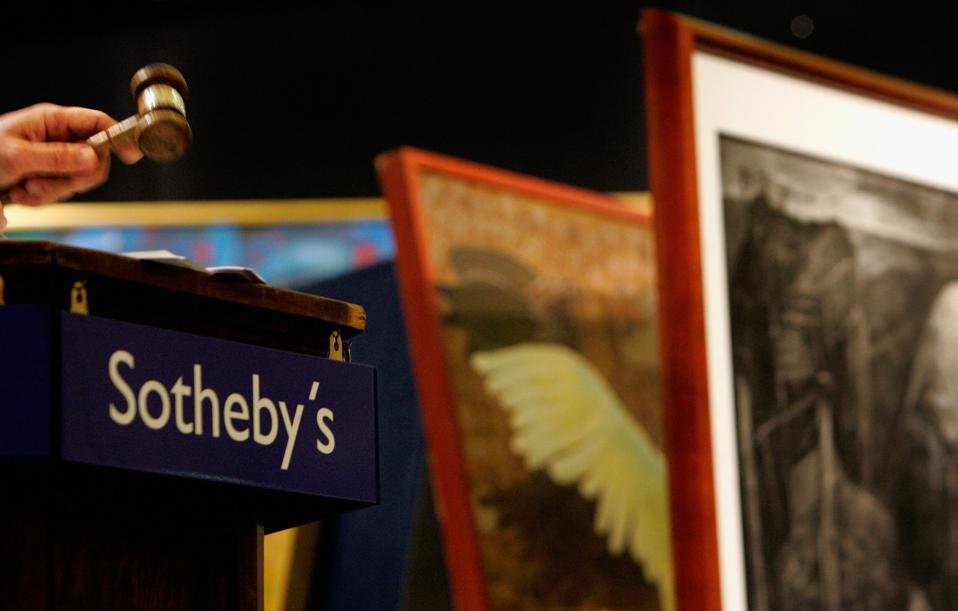

If your client is an artist, collector, or inheritor of art, when it comes time to plan to sell or gift the art, sale at auction could result in half of the hammer price going to taxes and fees. Consider using the charitable status of organizations like the Center for Art Law or Charitable Trusts to help defer or avoid the tax.