Publications

Facing Estate Tax Challenges For Business Owners, Artists, And Gallery Owners

As 2024 progresses, the sunsetting of key tax provisions presents unique challenges for business owners, artists, art dealers, and gallery owners alike. With the estate tax exemption set to decrease and potential changes looming in capital gains and valuation practices, it is crucial to review and adapt estate and tax plans to avoid pitfalls.

Do The Right Thing: Returning Looted or Stolen Art (and How Not to Buy It in the First Place)

Returning stolen and looted art is a complex and lengthy process, involving legal and political challenges. Nonetheless, transferring ownership to the government for repatriation, as exemplified by the Worcester Art Museum, aligns with property laws and represents the morally right course of action. Objects of this nature should be returned to their rightful owners or to the countries or cultures from which they originated if there is any doubt regarding their true ownership. To safeguard yourself from such situations, diligent research and thoroughness are imperative.

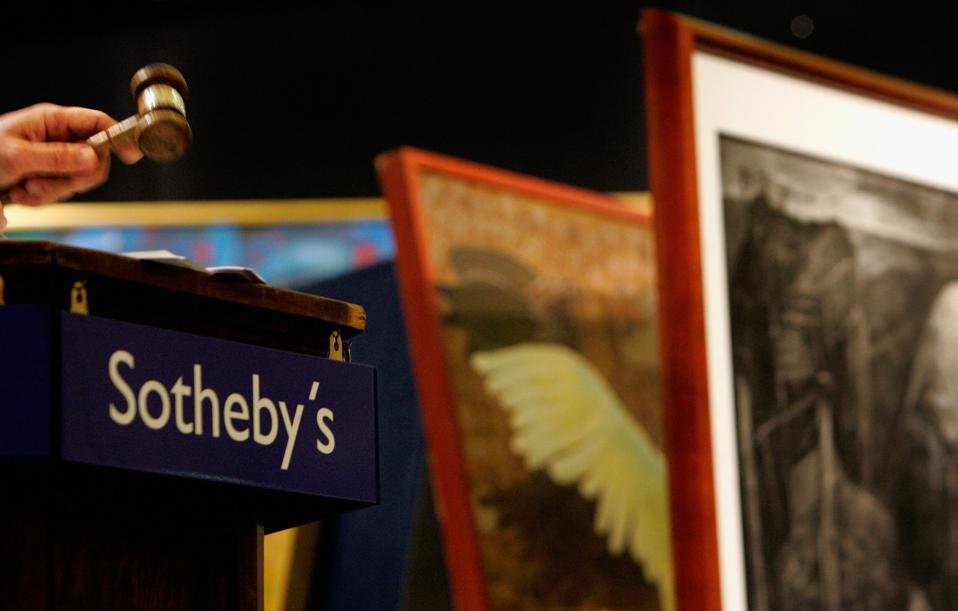

Avoiding (or at Least Deferring) Taxes on the Sale or Gifting of Art

If your client is an artist, collector, or inheritor of art, when it comes time to plan to sell or gift the art, sale at auction could result in half of the hammer price going to taxes and fees. Consider using the charitable status of organizations like the Center for Art Law or Charitable Trusts to help defer or avoid the tax.

Highlights Of the Art Market in 2022

Artprice.com has released its report, “The Art Market in 2022”. At 72 pages, it is a comprehensive look at the global art market, which is especially interesting to professional advisors to collectors of Art. International fine art auction turnover rose slightly in 2022, more than one million artworks appeared at auctions in 2022, of which almost two-thirds (65%) found buyers.

People Will Pay For Comics NFTs: Why Does It Matter?

NFT collectors value the ownership and control of these digital assets, often above their market value so estate planners must utilize and take advantage of unique estate planning techniques, such as a scenario planning process, illustrating for the clients, the process used to preserve the ownership of these assets, as if we were telling a story, in which the desired ending satisfies the client’s needs.

Going Beyond Preserving A Collection – The Private Operating Foundation

Many times, an artist or collector wishes to preserve their art collection by donating the collection to a museum or charity. Often the museum, university or other organization is unwilling or unable to integrate, preserve, store and display the entire collection along with the associated documents. Even if there is a financial gift to sufficiently endow the collection today, there is no certainty that the endowment will be able to fund the charity indefinitely into the future. If you are an artist or a collector wanting to preserve your collection, consider a Private Operating Foundation. This entity can be used not only to preserve a legacy but to define and shape the future.

Own A $7 Million Trading Card? Time To Do Some Income Tax Planning!

Baseball cards, and other trading cards have had a surge in popularity. Finding and selling one of these valuable cards could be a great return! When you do, also need to think about income taxes when you sell artwork or collectibles. Your income from selling tangible assets, such as trading cards, is taxed differently than income or gains from other investments. How you own a collectible will control how much income tax you will pay on the gains from a sale.

The Met Is selling Art? The Debate Over Deaccessioning Continues

The business model of every art museum has been under enormous stress during the pandemic and economic reality of 2020. The American Association of Museum Directors made a 180-degree turn on the use of funds from the sale of art from the museum’s collection last spring allowing some of the proceeds to be used to meet operating costs. The debate continues over whether the temporary lifting of the restrictions should be made permanent, amplified by the Metropolitan Museum of Art considering selling art and using the proceeds to cover operating costs.

Whither Donations Of Art To Museums In 2021?

What is the future of art collections and museum donations for 2021 and beyond?

Will museums with limited capacities be willing and able to accept specific artwork or even entire collections, now owned by artists and collectors who are in their 80’s and 90’s?

“What is required is planning for a current and ongoing collaboration between artists and collectors on one hand,and museums on the other for the creation and access to a virtual as well as physical collections.”

FFI: Family Offices and Artwork: Mitigating the risks

Families that use family office services expect family office professionals to help them mitigate risks, both to investments and to concentrated illiquid holdings, such as real estate or closely-held businesses. What sometimes goes overlooked, however, is how to mitigate the risks of ownership of artworks, numismatics, jewelry, cars, and other collectibles. Risk mitigation for these treasures begins with documenting what the client has, aggregating the individual items into collections, and beginning the management of the items as a collection.

Forbes: Thoughts On Collecting Art

The recent death of famed art collector Sheldon Solow has raised in my mind the more common question for estate planners about what to do with art in an estate. Once a person starts accumulating Art, their mind often turns to forming a Collection. Any estate planner for the collector should ask some hard questions. The fact is that Art of every description are sold each year as adding to a collection; unhappily, most of these collections fail in the long or short term to be financially or artistically successful and end up being broken up at the death of the Collector. If you are intent on creating a collection, here are a few thoughts on what to do, and not do, from an estate planner’s perspective.