Corporate Transparency Act: Updating Legal and Other Documents

Corporate Board Room Table with several executive chairs-Wilson, Getty Images

Wealth Management-

Practitioners need to modify their procedures to accommodate new requirements.

The filing requirements of the Corporate Transparency Act (CTA) took effect Jan. 1, 2024, so all practitioners must now address the CTA.1 Whether practitioners will handle filings, or endeavor not to, they may be inundated with questions from clients. While there are many articles that summarize the CTA and the regulations that the Financial Crimes Enforcement Network (FinCEN) has promulgated to implement its reporting requirements,2 few focus on the practical steps practitioners should take to modify their practices to accommodate the new CTA requirements. These will include changes to firm engagement letters, checklists, trust agreements and entity documentation to eliminate some potential roadblocks to CTA compliance, especially as to the risk of a beneficial owner not wishing to cooperate with the required reporting.

Even non-lawyers should understand some of these rules to better grasp the options they might consider. Some have suggested, for example, that to avoid exposing the beneficial ownership information (BOI) of individuals, and to relieve a reporting company from having to amend its BOI report after changes in BOI data, each individual should obtain a FinCEN identifier. Doing so, however, shifts part of the compliance burden from the reporting company to the individual. If an individual beneficial owner obtains a FinCEN identifier, the reporting company no longer must amend its BOI report within 30 calendar days after any change in that individual’s BOI. The individual, instead, undertakes a lifetime obligation to amend their FinCEN identifier application within 30 calendar days after any change in their BOI. Before drafting provisions into entities and trust documentation, attorneys and other advisors should be familiar with the implications of these approaches.

The Practitioner’s Role

Practitioners should consider what role they’ll serve in guiding clients on the CTA. Not advising clients at all is an unrealistic option, as clients, once the scope of the CTA becomes apparent to them, will reach out to their professional advisors for help. If clients can’t get the advice they need, they may retain other advisors to help. More dangerous for practitioners, some clients may assume that a particular professional is automatically handling their CTA obligations. That could prove disastrous when penalties are assessed and finger pointing begins. For example, clients may assume that the advisor who created an entity is somehow responsible for filing. Other clients may assume that the accountant who’s handling the tax compliance for a particular entity will, as part of that engagement, handle the CTA filings required. If this isn’t the case, advisors should clearly communicate it to clients.

Some advisors will want to avoid taking on the obligation to ensure that a reporting company files its BOI report correctly. In the same way that tax lawyers advise clients on their tax returns, we suspect that most lawyers will want to be available as needed, without taking on the obligation to ensure that the BOI report is filed correctly. Practitioners should consider this question, adopt a firm-wide policy if appropriate and then communicate to their clients the role they may serve. Even those firms that may have already distributed an introductory memo to their client mailing list may want to re-communicate the firm’s policy. Because the CTA is so new and different from prior reporting obligations, many clients may not have fully understood the initial communications. Also, until recently, there’s been little information in the general media to build awareness.

Engagement Letters

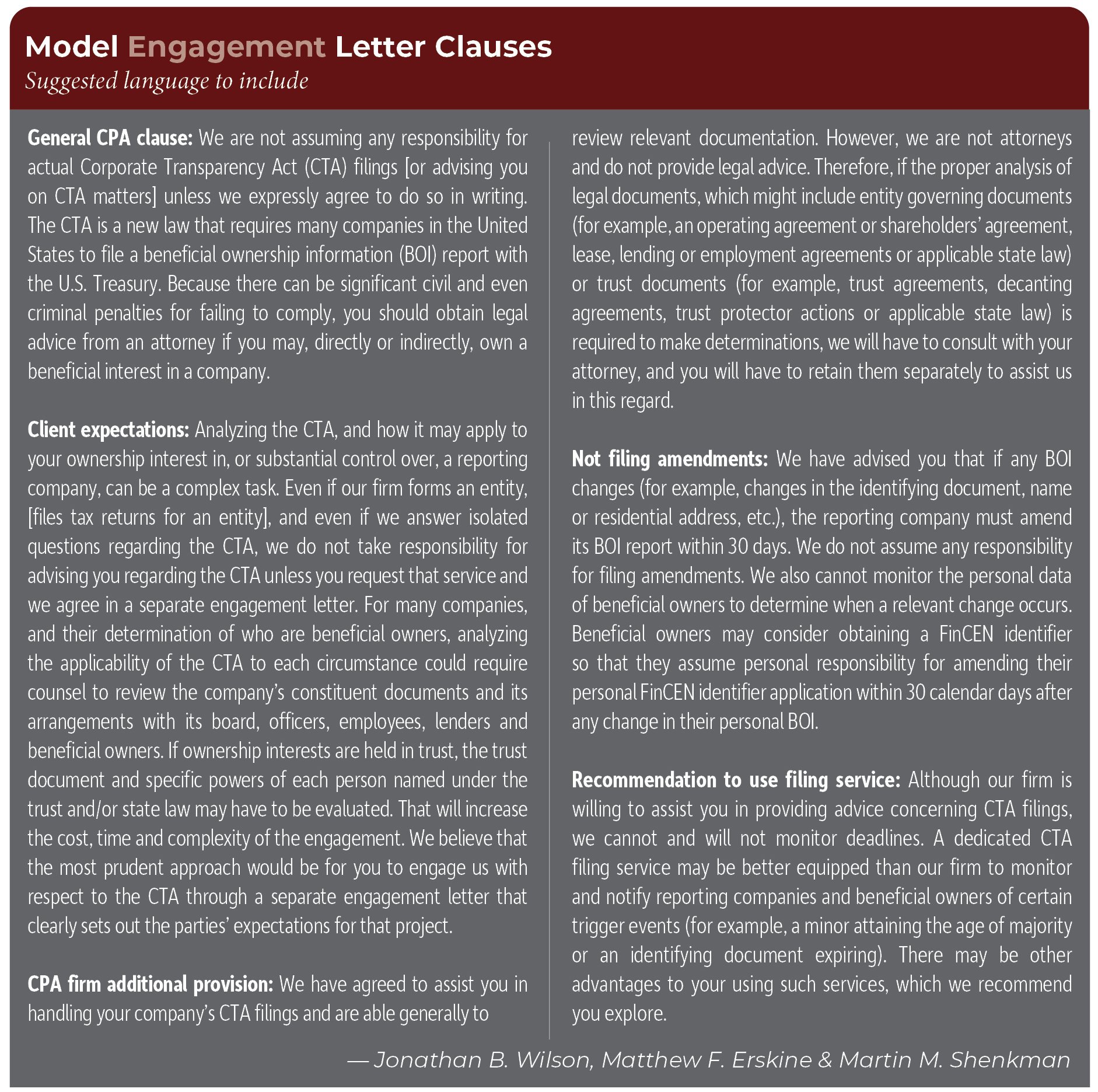

Once the advisor has adopted a CTA policy, the firm should review and modify its form of engagement letter to make clear what role the firm will play with respect to the CTA. Practitioners should update their engagement letters to reflect the role that they choose to serve with respect to CTA filings. “Model Engagement Letter Clauses,” this page, provides suggested language practitioners can use to clarify the role they’ll play with the CTA. It advises clients that the firm isn’t assuming any responsibility with respect to CTA filings unless a separate CTA engagement is signed. The model provides a short generic paragraph that disclaims responsibility and a second optional paragraph that provides a deeper explanation of the reason for the separate engagement. The goal of this type of default provision is to avoid client assumptions that the firm is automatically handling CTA matters. Another common goal may be expressly to avoid any responsibility or liability for filing amendments to CTA filings as these will be due in 30 days from the change in BOI, and it may be impossible for advisors to find out about such changes. Finally, advisors may consider recommending that the client retain an outside filing service to assist (which the firm may recommend), as that service may be better equipped than the professional firm to monitor and notify reporting companies and beneficial owners of certain trigger events (for example, a minor attaining the age of majority or a license expiring).

Trust Provisions

Most trusts aren’t reporting companies that are subject to the CTA. The CTA’s reporting rule defines “reporting company” to include corporations, limited liability companies (LLCs) and other entities that are either formed by the filing of a document with a secretary of state or are registered to do business in the United States by the filing of a document with a secretary of state. Trusts that are entirely private and aren’t formed by the filing of a document with a secretary of state aren’t reporting companies. Delaware statutory trusts and certain other trusts may be exceptions to this rule, but those aren’t addressed.

However, a trust may own an interest in a reporting company. When that happens, the reporting company must determine whether the trust (or its grantor, trustee, beneficiary, trust protector, etc.) is a “beneficial owner” as defined in the reporting rule. Practitioners should be alert to the fact that an individual who “exercises substantial control” over the reporting company is a beneficial owner regardless of whether that individual owns an interest in the reporting company. In the trust context, for example, certain individuals may have powers that characterize them as having control over the trust’s investments during the settlor’s life. On the settlor’s death, new positions and people may assume control over the trust and thereby become individuals who exercise substantial control over the reporting company.

The reporting rule provides that if a trust would be a beneficial owner of the reporting company, the reporting company should identify as the beneficial owner either: (1) the trustee (if the trustee has the authority to dispose of trust assets); (2) the beneficiary, if the beneficiary is: (i) the sole permissible recipient of income and principal from the trust; or (ii) has the right to demand a distribution of or withdraw substantially all the assets from the trust; or (3) the grantor/settlor, if the grantor/settlor has the right to revoke the trust or otherwise withdraw the assets of the trust.3 The implementation of these rules can be particularly complex. For example, if a beneficiary defective irrevocable trust is created, the heir/Crummey power holder will have the right to withdraw the entire $5,000 gift to the trust by the settlor, which constitutes all of the assets of the trust on formation. But in later years, that same individual won’t have that right as no future gifts are typically made. However, that individual might also serve as an investment advisor and exercise substantial control over the reporting company. This individual would therefore be a beneficial owner of the reporting company for a different reason.

This rule of beneficial ownership attribution puts the trust, its trustee and its counsel in a dilemma. While they may have a duty to keep information about the trust and its beneficiary confidential, the trust also has a duty to provide the requisite information to the reporting company to allow it to reach a determination regarding which individual should be identified as a beneficial owner.4 In addition, while the trustee may have a duty to provide the reporting company with information regarding the trust’s beneficiary or grantor/settlor (depending on the application of Section 380(d)(2)(ii)(C) of the reporting rule), the trustee wouldn’t ordinarily have a right to compel those individuals to provide their personal information.

To avoid these dilemmas, consider modifications to the trust documentation to permit the trustee to provide a reporting company with information required to determine which individual should be identified as a beneficial owner. They should also empower the trustee to compel any grantor, settlor or beneficiary to provide their personal information as and when it must be provided to a reporting company for CTA compliance purposes. See “Sample Trust Agreement Provisions,” p. 40.

©️ Wilson, Erskine, and Shenkman 2024

Document Collection Checklist

A first step for any advisor should be to collect all the constituent documents regarding the reporting company and its arrangements with its investors, board and senior officers. The reporting rule defines a “beneficial owner” as an individual who either owns directly or indirectly 25% or more of the ownership interests in a reporting company or who has “substantial control” over the reporting company. The beneficial owner definition refers to an “individual,” so in most cases the determination will require the advisor to look past corporate intermediaries that own an interest in the reporting company to identify the natural persons who are the beneficial owners of those intermediaries. The reporting rule also defines the term “substantial control” through a lengthy facts-and-circumstances test that requires the review of all the applicable documents that bear on the decision-making processes of the reporting company.5

Below is a checklist of documents that practitioners may need to collect to determine the beneficial ownership or substantial control over a reporting company. The checklist has separate subparts that depend on whether the reporting company is a corporation, a limited partnership or an LLC. Because of the facts-and-circumstances test involved in the determination of “substantial control,” practitioners should be alert to nuances and arrangements that might affect such a determination. Complex structures may require additional documents. This list makes clear that the scope of work for all but the simplest situations may be quite involved:

Corporations

1. Articles of incorporation. Include every amendment or amended and restated version.

2. Organizational consent. The initial written consent of the organizer of the corporation or the initial written consent or resolutions of the founding shareholders or initial board of directors of the corporation.

3. Bylaws. The bylaws of the corporation, together with every amendment.

4. Board minutes. Any minutes of meetings of the board of directors or other resolutions adopted by the board of directors that have any bearing on who may:

• appoint or remove any member of the board,

• appoint or remove any senior officer of the corporation, or

• make any major decisions affecting the corporation.

5. Shareholders’ agreement. If the agreement is amended and restated, only the current agreement may be necessary; if not, the initial agreement and all amendments should be provided.

Limited Partnerships

1. Certificate of limited partnership. Include every amendment or amended and restated version.

2. Partnership agreement. The partnership agreement that governs the company, together with every amendment.

3. Resolutions and written consents. Any resolutions or written consents adopted by the partners or any other applicable document that may have any bearing on who may:

• appoint or remove any person who exercises control over the company,

• appoint or remove any senior officer of the company, or

• make any major decisions affecting the company.

LLCs

1. Articles/certificate of organization.

2. Operating agreement. The agreement that governs the company, together with every amendment.

3. Resolutions and written consents. Any resolutions or written consents adopted by the members or managers or any other applicable document that may have any bearing on who may:

• appoint or remove any person who exercises control over the company,

• appoint or remove any senior officer of the company, or

• make any major decisions affecting the company.

Other Documents (for all structures)

Any other document, including contracts, policies, arrangements, understandings or agreements, through which any individual has the power or practical ability to:

1. appoint or remove any individual who exercises control over the company,

2. appoint or remove any senior officer of the company, or

3. make any major decisions affecting the company.

These documents include lease agreements that contain percentage rent or control mechanisms, employment agreements that reflect control under the CTA exercised by a key employee, profit sharing, phantom stock and similar equity like arrangements. Here are some examples:

Ownership table. A table that lists the full legal name of each individual or entity that owns an interest6 in your company. For each interest, provide any relevant details and documentation for the interest. For any person on the table who isn’t a natural person, provide an additional table that contains the full legal name of each individual or entity that owns an entity in that person, with the same details and documentation as described in the preceding sentence.

List of senior officers. A list of all the “senior officers” of the company, which is defined as any individual holding the position or exercising the authority of a president, chief financial officer, general counsel, chief executive officer, chief operating officer or any other officer, regardless of official title, who performs a similar function.7 Titles shouldn’t be viewed as the determining factor but rather the degree of substantial control that the individual or position has over the reporting company.

If a trust owns an interest in a reporting company, the following documents and information are needed:

Copy of the trust document with all amendments/modifications or actions to date. The nature and title of the documents will vary depending on whether the trust is revocable, irrevocable or has other characteristics.

List of all trustees, including special purpose delegated trustees.

List of all parties who aren’t beneficiaries, such as asset managers, accountants, and legal counsel who may have substantial control over the trust.

Name and contact information of the grantor of the trust.

Name and contact information of the current income beneficiaries of the trust.

Name and contact information of the current principal beneficiaries of the trust. If same as income beneficiaries, so indicate.

Name and contact information of any individual who holds a currently exercisable general or specific power of appointment, whether lifetime or testamentary. Name and contact information of any individual who holds a general or specific power of appointment, whether lifetime or testamentary, exercisable in the future and an indication of when that power may be exercised.

Any document, such as a will or trust, through which additional interest in the reporting company may be transferred to the trust.

Any document, such as a buy-sell agreement, which triggers the transfer of interest in the reporting company.

Endnotes

1. The Corporate Transparency Act (CTA) is Title LXIV of the William M. (Mac) Thornberry National Defense Authorization Act for Fiscal Year 2021, Public Law 116–283 (Jan. 1, 2021) (the NDAA). Division F of the NDAA is the Anti-Money Laundering Act of 2020, which includes the CTA. Section 6403 of the CTA, among other things, amends the Bank Secrecy Act by adding a new Section 5336, Beneficial Ownership Information (BOI) Reporting Requirements, to subchapter II of chapter 53 of title 31, U.S. Code.

2. BOI Reporting Requirements, 87 Fed. R. 59,498, codified as 31 CFR Section 1010.380 (Sept. 30, 2022) (Reporting Rule).

3. 31 CFR Section 1010.380(d)(2)(ii).

4. This duty arises from subsection (g) of the Reporting Rule, which places potential criminal liability on any individual who causes a reporting company’s BOI report to be inaccurate by providing it false information or by withholding required information so that the reporting company “fails to provide such information.”

5. Reporting Rule, subsection (d)(1).

6. An “interest” includes all securities of every kind. This includes common stock, preferred stock, membership interest, economic interest, voting rights, profit sharing rights and debt instruments that are convertible into other securities. Reporting Rule, subsection (d)(2)(i).

7. Reporting Rule, subsection (f)(8).